We can't go on like this

Medicare and Social Security accounted for 38% of all federal spending in 2012. The Affordable Care Act has succeeded in delaying Medicare's "day of reckoning" by several years until 2026. The act accomplishes this by imposing higher payroll taxes on high wage earners, reducing payments to Medicare Advantage plans, and reducing the growth in payment rates for many health service providers, excluding physicians and drug companies. However, long-term imbalances remain between program benefits and Medicare's tax base, and these imbalances must be fixed if we wish to preserve Medicare for today's working men and women.

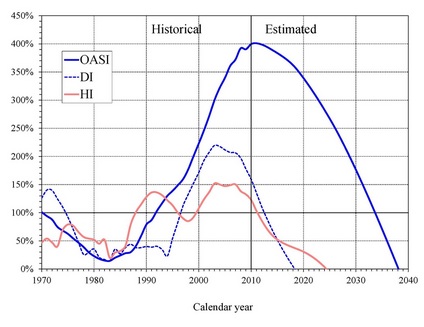

Medicare was enacted in 1965 at a time when only about half of the elderly had any private health insurance, and this insurance generally only covered inpatient hospital costs. At the time of its creation, it was quite affordable and an excellent value for the nation. However, its relative cost to the country has risen inexorably while its asset base has not been able to keep up. Despite increased payroll taxes over the years and the further reforms of the Affordable Care Act, payments to providers from Medicare's Hospital Insurance (HI) Trust Fund have exceeded income into the Trust Fund since 2008, and the fund is expected to reach the point of exhaustion in 2026. This is graphically illustrated in the chart above. (The pink line represents the HI Trust Fund; the dashed blue line represents Social Security's Trust Fund for the Disabled, and the solid blue line represents the general Social Security trust Fund).

Medicare's Hospital Insurance (HI) Trust Fund is financed primarily by payroll taxes, and these are woefully inadequate to keep pace with spending. Once the trust fund fails in 2026, dedicated revenue would be sufficient to pay only 87 of the trust's bills to our nation's hospitals--gradually declining to 71%-- for taking care of our country's elderly. This situation would result in a terrible political cacophony; most hospitals could not survive on 87%, not to mention 71%, of Medicare's customary payments, and this would place the health of the elderly in serious peril.

The situation for physician spending by Medicare is no better. Physician payments are made by the Supplementary Medical Insurance (SMI) Trust Fund. This fund is financed by general federal revenue and enrollee premiums. Therefore, while there is no fear of trust fund exhaustion, the SMI continues to require an ever larger share of the federal budget. In 2010, the federal government paid $220 billion into the fund, and this amount is expected to balloon indefinitely into the future. The kicker here is that these projections assumes that the federal government will find the will to cut physician payments by nearly 30% in 2010 as required by the sustainable growth rate formula of federal law. (The AAOS and most other physician advocacy groups oppose this cut, and it has been postponed for many years, but if it is not made, the problem will only become that much worse.) Even assuming this scheduled sustainable growth rate cut is made, the expected annual increases in physician spending are, of course, well in excess of likely GDP growth or federal tax revenue growth, and as a consequence, Part B Medicare financing will consume an ever larger portion of the federal budget. Looked at another way, even assuming the large and bitterly unpopular (with many physicians) sustainable growth rate cuts are made, Medicare's payments to doctors are expected to grow from 2% of GDP in 2012 to 3.3% in 2035.

Current efforts in Washington to continue to solve this pending Medicare disaster involve further efforts to lower the costs of health care to all Americans. The magnitude of this crisis, too, cannot be overstated. In 2013, family costs for employer sponsored health insurance averaged $16,351--nearly doubling the average family cost of $9068 in 2003. Furthermore, the average worker's share of these costs increased 89% during this time to $4565.

The issue for us then becomes our response to the economic crisis facing Medicare and our health care system. Some physicians advocate and societies recommend that we flex our muscles--refuse to treat Medicare patients--unless the government finds a way to keep paying us as at least as richly as it currently is. While we strongly doubt that most practicing orthopedists could afford to engage in such a job action, our society's response to such an idea is that it is both irresponsible and unreasonable. As this and other posts on our website clearly demonstrate, current payment practices cannot continue. Over time, not only will they bankrupt our country, they will drain money from every other government service. We cannot expect to receive an ever greater share of America's GDP for our work. As in any zero-sum situation, as we take more and more, less is left for everyone else. Furthermore, as is amply demonstrated on the post, An Historical Perspective, we, as orthopedists, continue to enjoy incomes far above the historical average for our profession. If inspirational historical figures in orthopedists could enjoy their profession for lower average salaries, so can we. While we take no comfort or joy in our outlook for health care financing, a cold look at current medical finances at both the state and federal levels convinces us that change is coming. We wish to advocate strongly that our primary duty during this period of tumult is to protect our patients; we must continue to put their needs first in any decisions regarding our professional lives. Our patients must continue to enjoy access to quality health care, and, therefore, we, as surgeons, must continue to provide that health care. We oppose any organized effort to use limited physician access as a lever or tool to extract greater income from the government. We support health care strategies, including those that limit provider income, that maintain access to quality health care for as many people as possible while the states and federal government work to resolve our looming and difficult health care crisis.